Investing consistently in the stock market is a proven strategy for building wealth over time. As a Singaporean investor, you might wonder how to automate this process, especially when investing in international markets like the S&P 500. This guide will walk you through automating your investments using your bank accounts, Interactive Brokers (IBKR), and selecting the right S&P 500 ETF.

Why Automate Your Investments?

Automation removes the emotional aspect of investing, ensuring you stay consistent regardless of market fluctuations. It also saves time and reduces the hassle of manual transactions, making your investment journey smoother.

Step 1: Set Up Your Interactive Brokers (IBKR) Account

a. Open an IBKR Account

- Visit the IBKR Website: Go to Interactive Brokers and click on “Open Account.”

- Complete the Application: Provide the necessary personal information and documentation for verification.

- Account Verification: Wait for the confirmation email indicating your account has been approved.

b. Link Your Bank Account

- Log In to IBKR: Access your account dashboard.

- Navigate to Banking: Go to “Transfer & Pay” and select “Transfer Funds.”

- Add Your Bank Details: Enter your bank account information.

- Verify Account: Follow any additional steps required to verify your bank account linkage.

Step 2: Fund Transfer from Bank to IBKR

a. Initiate a Transfer (one off)

- Log In to Your Bank Account: Access your online banking platform.

- Set Up a Transfer: Choose “Transfer Funds”.

- Enter IBKR Details: Input your IBKR account number and the necessary bank details provided by IBKR. (You must first start a deposit on IBKR and get the instructions)

b. Set Up Recurring Transfers

- Standing Instruction: Set up a standing instruction for monthly transfers to your IBKR account. (usually under transfers > other services)

- Amount: Decide on a fixed amount to invest regularly.

- Schedule: Choose a date each month when the transfer will occur, it is advisable to do it on the same day or +1 day after payday.

Note: Ensure you account for any bank fees associated with overseas or recurring transfers.

Step 3: Automate Currency Conversion (SGD to USD) with Lower Fees

When investing in international markets like the S&P 500, currency conversion is a necessary step. Fortunately, Interactive Brokers (IBKR) offers a seamless and cost-effective way to automatically convert your SGD deposits to USD with lower fees.

a. Automatic Currency Conversion upon Deposit

- Deposit SGD into IBKR: When you transfer funds from your bank account, deposit them in Singapore Dollars (SGD) directly into your IBKR account.

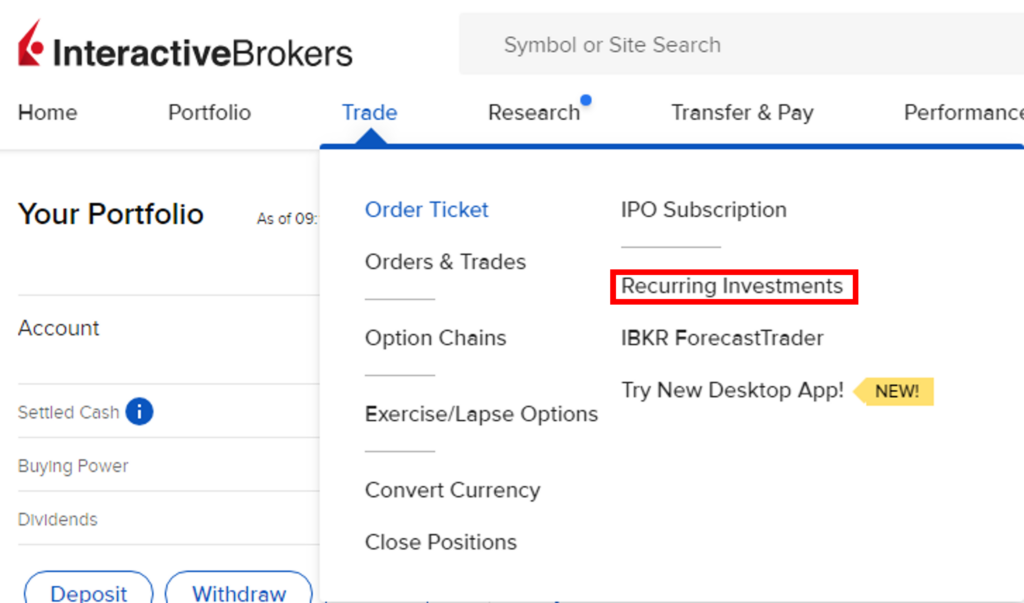

- Set Up Recurring Investments: Establish a recurring investment plan for your chosen S&P 500 ETF within IBKR.

- Automatic Conversion: IBKR will automatically convert your SGD to USD at the time of your investment purchase, using competitive forex rates.

- Lower Fees: This automatic conversion leverages IBKR’s low commission rates for currency exchanges, often much lower than traditional banks.

b. Benefits of IBKR’s Automatic Conversion

- Competitive Exchange Rates: IBKR provides near interbank exchange rates, ensuring you get more USD for your SGD.

- No Manual Intervention Needed: Eliminates the need to manually execute forex trades or monitor exchange rates.

- Cost Efficiency: Lower conversion fees mean more of your money goes into your investments rather than towards transaction costs.

Step 4: Choose the Right S&P 500 ETF

Selecting the appropriate ETF is crucial for maximizing returns and minimizing taxes.

a. Opt for Ireland-Domiciled ETFs

Ireland-domiciled ETFs offer tax advantages for non-U.S. investors, including reduced withholding tax on dividends and no U.S. estate tax concerns.

b. Recommended ETFs

- iShares Core S&P 500 UCITS ETF (CSPX)

- Ticker: CSPX (LSE)

- Currency: USD

- Benefits: 15% withholding tax on dividends.

Note: Avoid U.S.-domiciled ETFs like SPY or VOO due to higher tax implications.

Step 5: Monitor and Adjust Your Investments

a. Regular Portfolio Reviews

- Monthly Check-ins: Ensure your investments are proceeding as planned.

- Adjust Transfers: Modify your recurring transfer amounts if necessary.

b. Stay Informed

- Market Updates: Keep abreast of market conditions that may affect your investments.

- Rebalance if Needed: Adjust your portfolio to maintain your desired asset allocation.

Additional Considerations

Fees and Charges

- IBKR Commissions: Be aware of trading fees associated with ETF purchases.

- Currency Conversion Fees: Consider the costs involved in forex transactions.

Regulatory Compliance

- Tax Obligations: Understand your tax responsibilities in Singapore.

- Regulations: Ensure compliance with Monetary Authority of Singapore (MAS) regulations.

Seek Professional Advice

- Financial Advisors: Consult with professionals for personalized investment strategies.

- Tax Consultants: Get advice on tax-efficient investing and reporting.

Conclusion

Automating your investments as a Singaporean investor involves setting up recurring fund transfers from your bank account to IBKR, automating currency conversions, and using conditional orders to purchase tax-efficient, Ireland-domiciled S&P 500 ETFs like CSPX. This strategy simplifies your investment process, promotes consistency, and optimizes tax efficiency.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a professional advisor before making investment decisions.

Do you have experiences with automating your investments? Share your thoughts in the comments below!