Investment Options in Singapore: ILPs, Unit Trusts, and Bonds

Are you considering your investment options in Singapore? Here’s a quick overview to help you choose between Investment-Linked Policies (ILPs), Unit Trusts, and Bonds.

Why You Should Care About Fees, Returns, and Minimum Investments

When deciding where to put your money, the most crucial factors to consider are potential returns, associated fees, and how much you need to start investing. Understanding these elements will help you make an informed decision that aligns with your financial goals.

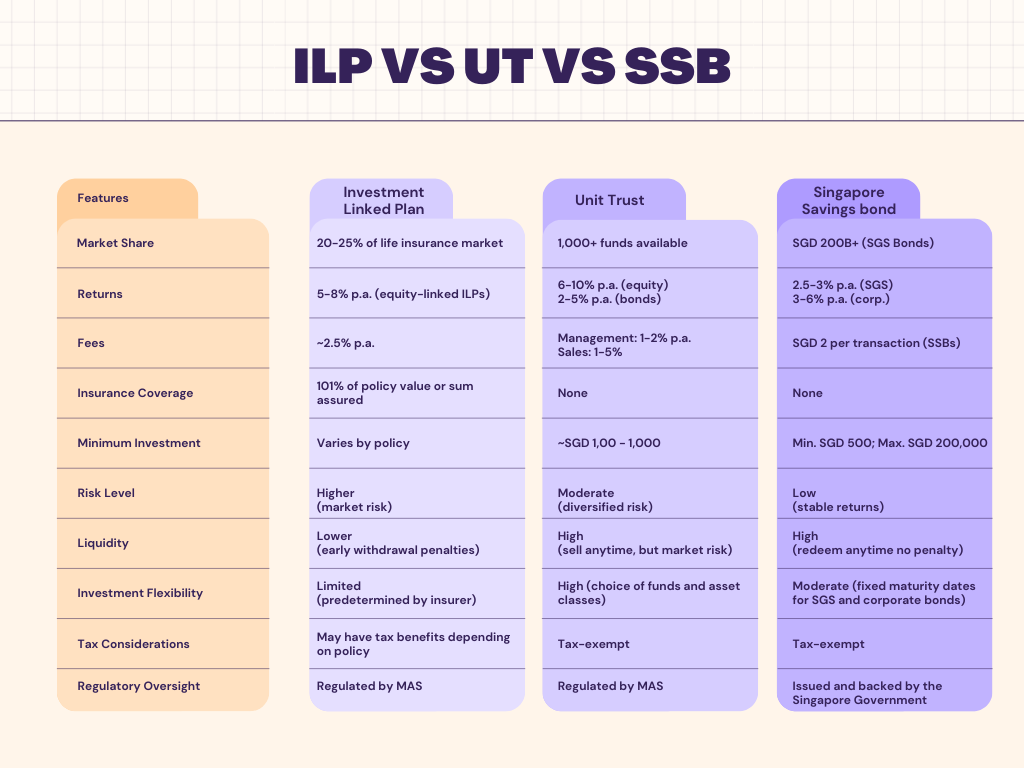

Quick Comparison: ILPs vs. Unit Trusts vs. Bonds

Summary Table

| Feature | ILPs | Unit Trusts | Bonds (SSBs) |

|---|---|---|---|

| Returns | 5-8% p.a. (equity-linked ILPs) | 6-10% p.a. (equity); 2-5% p.a. (bonds) | 2.5-3% p.a. (SGS); 3-6% p.a. (corporate bonds) |

| Fees | ~2.5% p.a. | Management: 1-2% p.a.; Sales: 1-5% | SGD 2 per transaction (SSBs) |

| Minimum Investment | Varies by policy | ~SGD 100 – 1,000 | Min. SGD 500; Max. SGD 200,000 |

| Risk Level | Higher (market risk) | Moderate (diversified risk) | Low (stable returns) |

| Liquidity | Lower (early withdrawal penalties) | High (can sell anytime, but market risk) | High (can redeem anytime without penalty) |

| Investment Flexibility | Limited (predetermined by insurer) | High (choice of funds and asset classes) | Moderate (fixed maturity dates for SGS and corporate bonds) |

| Tax Considerations | May have tax benefits depending on policy | Gains are generally taxable unless under SRS | Interest from SGS and SSBs is tax-exempt |

| Regulatory Oversight | Regulated by MAS (Monetary Authority of Singapore) | Regulated by MAS and governed by the CIS Code | Issued and backed by the Singapore Government |

Investment-Linked Policies (ILPs)

ILPs combine life insurance with investment. The insurance component ensures a payout of 101% of the policy value or the sum assured, whichever is higher. However, ILPs typically come with higher fees (around 2.5% per annum) that can eat into your returns.

Unit Trusts

Unit Trusts offer a diverse range of funds, managed by both local and international fund houses. They provide moderate returns (6-10% for equity funds, 2-5% for bond funds) with management fees ranging from 1-2% per annum. You can start with a minimum investment as low as SGD 100.

Bonds (SSBs)

Singapore Savings Bonds (SSBs) and other bonds provide stable returns with minimal risk. SSBs have a minimum investment of SGD 500, with low transaction fees of just SGD 2. They are ideal for conservative investors seeking consistent returns.

Conclusion

Your choice of investment should depend on your risk tolerance, financial goals, and the amount you’re ready to invest. ILPs offer the dual benefit of insurance and investment but come with higher fees. Unit Trusts provide flexibility and moderate returns, while Bonds are the go-to for low-risk, stable returns.

Ready to invest? Make sure to compare these options and choose what aligns best with your financial objectives!