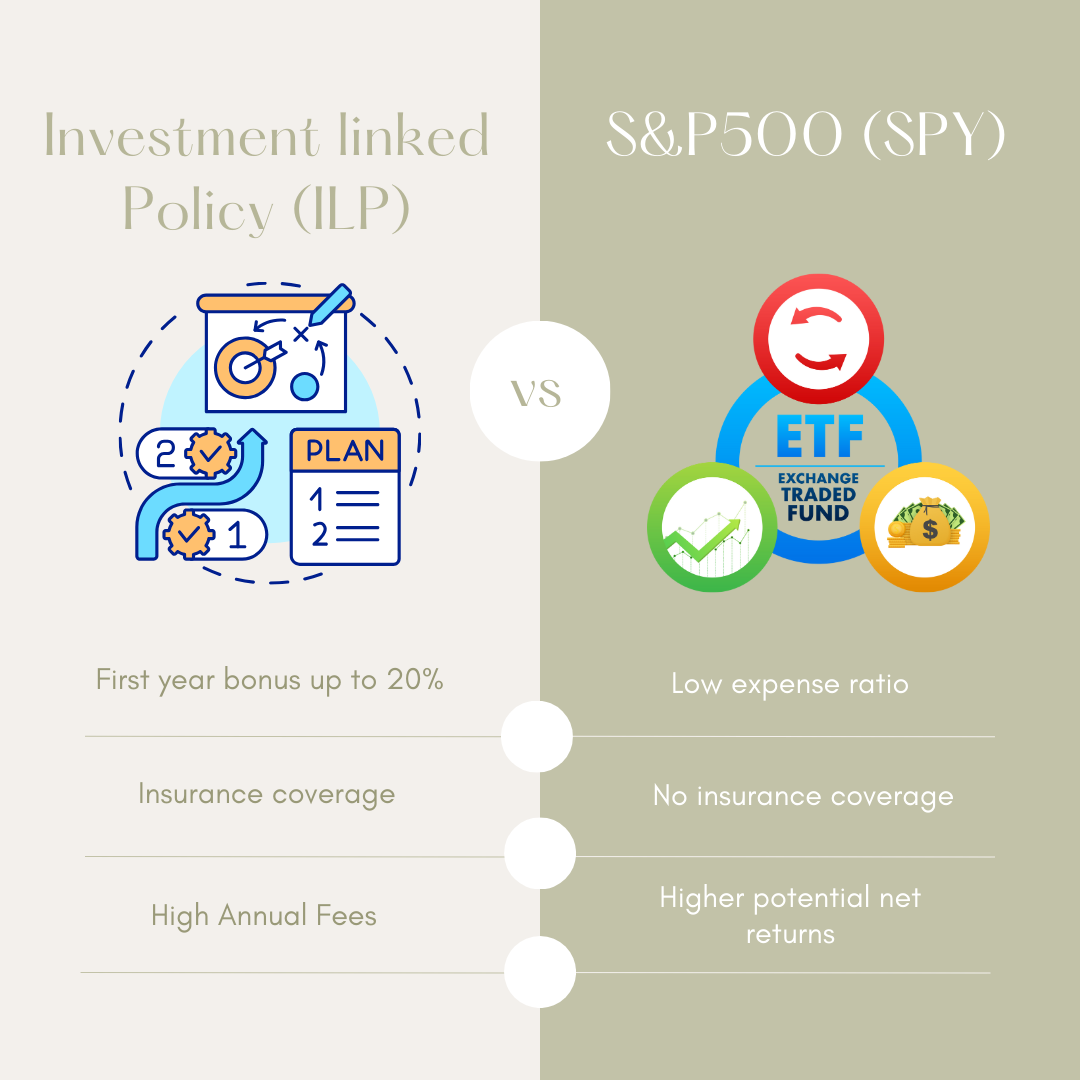

When deciding between an Investment-Linked Policy (ILP) and a standard investment such as the SPDR S&P 500 ETF (SPY), understanding the impact of fees on your long-term returns is crucial. This article will be doing a detailed comparison between the two options, using an example scenario with annual contributions, typical ILP fees, and the SPY expense ratio.

Scenario Assumptions

- Annual Contribution: SGD 5,000

- ILP Fees: 2.5% of the account value annually, with a 20% bonus on the first-year contribution.

- SPY Fees: 0.09% expense ratio (common for ETFs like SPY).

ILP Example

First-Year Contribution (Including Bonus):

- Initial Contribution: SGD 5,000

- 20% Bonus: SGD 1,000

- Total Account Value After Year 1: SGD 6,000

Subsequent Contributions:

- Each Year: SGD 5,000

- By the End of 10 Years (Without Fees): Account value could be around SGD 60,000 (assuming no growth or decline in value).

Impact of ILP Fees (2.5% Annually):

- By Year 10: Assuming the account grows annually and reaches around SGD 60,000, the annual fee would be: SGD 1,500 (2.5% of SGD 60,000) per year.

- Total Fees Over 10 Years: Estimated around SGD 5,000 – SGD 6,000, reducing your net return significantly.

SPY Example

Annual Contribution:

- Each Year: SGD 5,000

- Total Contribution Over 10 Years: SGD 50,000

Impact of SPY Fees:

- By Year 10: If the account value is around SGD 60,000 (assuming growth), the annual fee would be: 0.09% of SGD 60,000 = SGD 54/year.

- Total Fees Over 10 Years: Approximately SGD 250 – 300, which is much lower than the ILP fees.

ILP Fees vs SPY Fees Over 10 Years

Comparison Summary

Comparing the two options, here’s a summary:

| Parameter | ILP | SPY |

|---|---|---|

| Initial Contribution (Year 1) | SGD 5,000 + SGD 1,000 Bonus | SGD 5,000 |

| Annual Fee | 2.5% of Account Value | 0.09% of Account Value |

| Total Fees Over 10 Years | SGD 5,000 – 6,000 | SGD 250 – 300 |

Important Considerations

While ILPs and SPY might appear comparable at first glance, it is important to remember that they serve very different purposes:

- ILP: Combines both insurance and investment. The fees include the cost of life insurance coverage, which can be valuable if you need both insurance and investment in one product. However, compared to purchasing a separate term insurance plan, the insurance portion of an ILP tends to be more expensive.

- SPY: Is purely an investment vehicle with no insurance component. If you require insurance, it might be more cost-effective to purchase a separate term insurance policy and invest the rest in a low-cost ETF like SPY.

Final Thoughts

While the ILP provides an initial boost with the 20% bonus, the high ongoing fees could substantially erode your returns over the long term. On the other hand, investing in SPY offers a much lower cost structure, leading to potentially higher net returns. When considering your financial strategy, it is essential to weigh these factors carefully and decide based on your specific insurance and investment needs.

We hope this analysis helps you make an informed decision. Feel free to share your thoughts in the comments below or reach out to us if you have any questions!

Best regards,

Hobo